These industries lead the way

Karthee Madasamy

Since reaching lofty, all-time highs in 2021, startup exits have hit all-time lows over the last 12 months as interest rates skyrocketed, access to cheap money dwindled, and opportunities to cash out dried up. The first half of 2023 saw the lowest combined exit value for U.S. companies and venture capital investors in about 15 years, according to PitchBook data.

However, in Q3, we saw some light at the end of the tunnel, with PE/VC exits in August hitting the highest they’ve been in over 22 months. Perhaps surprisingly, deep tech companies, which I’d define as novel technologies or those using engineering-led innovations, have contributed to that initial, slow rebound for those not closely following the area. Looking at the Crunchbase big board of $1 billion startup exits for 2023, a quarter of those 16 unicorn exits are deep tech companies. Given the sheer number of deep tech unicorns minted over the last few years, it’s not a surprise for our team. In 2021, we compiled a list of deep tech companies that had eclipsed the $1 billion valuation and found that 120 deep tech unicorns had already created nearly half a trillion dollars of value.

But for those not closely following the deep tech space day to day, it’s possible to still believe that you can’t build deep tech unicorns and that there are only a handful of deep tech exit opportunities each year. However, the truth is that deep tech innovations are no longer science fiction or research experiments. Many earth-changing deep tech solutions are being commercialized, and successful exits continue to increase in number and size. In that sense, deep tech exits are no longer science fiction either. To understand this better, our team recently analyzed global deep tech exits over the last decade for what we believe is the first time in the industry (2013–2022), and here is what we uncovered.

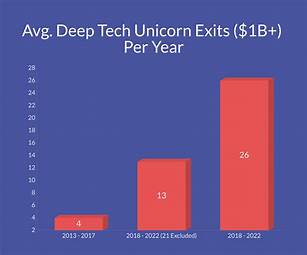

Deep tech unicorn exits from 2018–2022 increased 550%

Image Credits:MFV Partners

From labor shortages and supply chain disruptions to global chip dependency and the race to address the climate crisis, deep tech companies have become critical in solving the biggest challenges facing industries and society over the last decade. Those needs have accelerated the number and size of exits during that period. When you compare the first half of the decade (2013–2017) with the second half (2018–2022), you can see those exits take off. During the first half of the decade, there were 19 exits per year, with an average annual exit value of $14 billion. Compare that with 2018–2022, when deep tech exits jumped to 49 with an average yearly exit value of $103 billion.

Even if you exclude 2021 as a true outlier, given the backdrop of the SPAC heyday, there were 31 deep tech exits on average annually with an average yearly exit value of $40 billion. Perhaps even more impressively, the number of deep tech unicorn ($1 billion) exits jumped 550% to 26 on average per year between 2018 and 2022, compared to just four unicorn exits per year between 2013 and 2017. This finding illustrates that while deep tech companies may have slightly slower initial growth cycles as they address technological readiness, their valuation potential aligns with, or is even bigger than, software companies when they ultimately exit.

SPACs played an outsized role in 2021 exits, but deep tech IPOs and M&As steadily increase

Image Credits:MFV Partners

Of course, 2021 was a record year for SPAC (special-purpose acquisition company) mergers, with 613 filings taking place that year. Among them were many deep tech companies attracted to a faster and often more predictable path to becoming publicly traded than traditional IPOs. And while deep tech SPAC mergers accounted for over 50 of these 2021 exits, an approximately 333% jump from the prior year, there was also a jump in IPOs and M&A activity. Our research shows that M&A deals involving deep tech companies increased by nearly 300% between 2020 (10 deals) and 2021 (28 deals). Deep tech exits via traditional IPOs also multiplied, with the number of IPO exits in 2021 alone (42) outpacing the combined number of public offerings (39) made the three years prior (2018–2020).REGISTER NOW

In 2021, there were the most notable deep tech deals over the last decade, including electric vehicle makers Rivian (whose IPO exit valued them at $67 billion) and Lucid Motors (who went public via SPAC with an exit value of $24 billion). The transportation or mobility industry has played a significant role in deep tech exits over the last decade, which will likely continue in the near future. And while the IPO market has been essentially flatlined in 2023 for all venture-backed technology companies, Q3 is showing signs of life, with Instacart and Klaviyo proving in Q3 that you can go public in a down market without halving your valuation. Deep tech unicorns should follow in their path in Q1 of 2024, and overall deep tech exit levels should return to 2020 levels if interest rate hikes finally hit a ceiling.

Meanwhile, SPAC deals have died down since 2021 as the SEC increasingly scrutinizes them to ensure adequate investor protection and transparency. But they haven’t gone away completely. According to our data, 15 deep tech companies exited via this route in 2022. And of the $1 billion+ deep tech exits in 2023 to date, three of the four have been SPACs — including NET Power, Intuitive Machines, and LanzaTech.

Health tech, compute, and mobility drive deep tech exits

Image Credits:MFV Partners

Over the last 10 years, health tech companies — which we’ve defined as computational biology or device-based (biotechnology has been excluded) — with 99 exits, have accounted for the most deep tech exits. This was primarily driven by a significant focus on computational biology companies going public in 2015–2020. The second most popular exit category was compute, which includes areas like quantum computing and next-generation semiconductors. Across 12 months of 2021 and 2022, three quantum computing companies — D-Wave, Rigetti, and IonQ — went public. More will come as we reach the dawn of the quantum industry.

As we mentioned previously, transportation or mobility has also been a strong category of exits. If you look at exits by category when only considering $1 billion+ exits, transportation had more unicorn exits than health tech, which comes in second. Deep tech mobility companies, like those building autonomous vehicles, are changing how we move and are making us rethink how we design smart cities. There is also an intersection with AI and robotics, with robotic machines leveraging deep learning to operate autonomously and perform mobile physical tasks with greater precision, accuracy, and speed than humans can.

Fourth on the list of total exits was climate or clean energy, which has picked up again with the most recent climate tech renaissance. This should only increase with regulatory tailwinds driven by bills such as the Inflation Reduction Act. This creates a significant demand for companies utilizing physics and chemistry to address removing carbon from the atmosphere or lowering emissions. LanzaTech, which we noted above, went public through a SPAC this year. It is an example of one of these types of companies having developed a gas fermentation technology that can transform waste carbon into materials such as sustainable fuels, fabrics, and packaging.

Rounding out the top five categories of exits were data and applied AI companies. Given the current AI gold rush, we should expect this category to continue to rise in exits in the coming years. M&A will likely drive a significant percentage of these exits as larger companies look to ensure they aren’t left on the sidelines of the revolution by buying into AI innovation. A recent example of that can be seen in Databricks’ $1.3 billion acquisition of two-year-old AI startup MosaicML in June of this year.

There is little doubt that the landscape of deep tech exits has evolved significantly over the past decade. As the sector continues to mature, it’s clear that these innovations are no longer science fiction, and neither are the value of the deep tech businesses being built or the opportunities for significant exits.

The article originally appeared in TechCrunch, December 6, 2023